Living in a time where irrational generalisations often hinder financial decision-making – the art of cold, calculated precision and collusion is necessary for nations to shield themselves against the onslaught of any doubt.

The present

One very relevant instance of such a generalisation can be seen today with the phobia of emerging markets as foreign investors camp themselves in developed markets and cause currency depreciation. The process continues to devalue currency further as an initial fall in the value of a currency causes investors to pull out even more money from an economy. However, due to the globalised state of the world, this problem does not persist and impact one nation, but several others of a perceived similar stability and economic prowess.

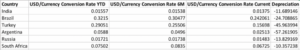

The data above helps indicate this very clearly, where countries like India, that have some of the fastest rates of growth, still witnessed a YTD 11.69% fall due to a major fallout in the currencies of Argentina and Turkey (greater than 45%). While India is still one of the least affected emerging markets in terms of currency devaluations, the fact that the country experiences such downfalls at all despite being one of the most rapidly growing emerging markets does raise eyebrows.

The past

This sentiment, however, is definitely not one that is specific to the modern day. The emerging markets have faced this prejudice for decades, one of the purest examples being the Asian crisis of 1997. Running large current account deficits, the Thai Baht was being converted rapidly into currencies of foreign exporters. This massive downward pressure on the currency had to be countered by the government to maintain the peg to the US Dollar, which involved selling massive reserves of foreign currency.

Unfortunately, unlike in the case where a currency is devalued – where one can just print money and sell one’s domestic currency – if one wants to elevate the currency value, finite currency reserves are exhausted. This limits the amount of intervention a nation can undertake.

With large amounts of debt circling the nation to fuel its massive infrastructural and economic boom, as soon as the peg was removed (due to the government’s inability to fund it) this debt became insanely expensive, crippling producers and the government.

Furthermore, as most of the speculative boom was attributed to real estate growth, one of the most illiquid assets of all, as soon as the speculative boom stopped, supply continued to grow rampantly. This can be linked to the fact that real estate projects take years to develop and therefore respond to changes in market forces very late. This contributed to lower real estate prices, causing further damage.

While this was the story in Thailand, most other Asian nations were not directly a part of this narrative. However, the aforementioned emerging markets generalisation became critical in hurting others, as foreign investors refused to put their money in this growing corner of East Asia. In fact, bbooming economies like Hong Kong in slumps, as the likes of Japan, Philippines and China were also affected.

The moral of this lesson seems to be that even if your neighbours commit mistakes, it is on you. Yet, instead of being overwhelmed by the bitter grimness of the truth, the solution would be to support one’s neighbours to support oneself. An interconnected network of dependent economies is in the best interest of everyone.

In the case of developing economies (susceptible to foreign influences in confidence and investment) showing signs of consolidated growth helps bring greater investor confidence and stability. While most may argue about the failure of collusions, with the EU on the tip of everyone’s tongue, the prime issue there is the hegemony in the level of growth and economic prowess between nations.

What is the solution?

Perhaps a solution is to form economic unions of developed economies responsible for collective discussions on the use of monetary policy, to prevent competitive predatoriness within nations formed on the basis of geographic positioning and political alliances.

Such nations could also discuss foreign aid through investment instruments, with a form of reciprocal investment plan like Japanese keiretsu, that mandates nations to invest substantial portions of money in fundamental parts of each others economies (the way Japan did to firms). While ASEAN does exist, its mandate is very vague and certainly does not emphasise crisis management and collective intervention.

The lack of an incentive to collude in existing supranational alliances deem them redundant, and a choice that nations can choose to avoid to gain from self-benefit that leads to chaos. As is in the case of any oligopoly, it is always in the short-term interest for firms to stop colluding and reap the benefits of their greed, yet reciprocal shareholding prevents such liberties, that are capable of making the proposed alliances mere choices.

Additionally, another system of mutual consolidation that has been a domestic success is that of banking clearing houses. Instead of having frequent payments due to trade, with crushing current trading account deficits, such unions could function on a tightly-consolidated economy that allowed larger overdrafts for nations in dire economic situations. Facilitation of cheaper debt could be done by paying off these overdrafts on an interest.

For instance, if Colombia is currently in a period of instability and has an account deficit of $100 million to Romania, Argentina could pay it off charging a low interest. While this is an example that involves trade with nations outside of the union, if this money was owed to Argentina, they could absorb this, charging interest temporarily until money is paid back. This is far better than panic aggravating the crisis, forcing the nation into eventual haircuts of debt that lead to a loss of trust and poor repayment of credit. Reciprocative trade in the long run could act as payment for this, reducing the net amount paid to the firm to whom debt is owed, where Columbia could sell over-stocked corn to Argentina as compensation.

Trust, therefore, becomes fundamental in maintaining stability, and pronouncing this through formal alliances, binding decisions and forming domestic eco-systems of trade is ideal.

In the face of failed global governments, rushed globalisation gives leeway for malpractice as nations still attempt to maximise their own gains. Thus, a gradual means of introducing globalisation by first establishing trusted domestic eco-political ecosystems, before moving onto cater to the world can become the missing piece in cracking the puzzle of international trade, riddled with bullies trying to punch down its neighbours.

Rishit Jain is a writing analyst at Qrius.

Post Disclaimer

The opinions expressed in this essay are those of the authors. They do not purport to reflect the opinions or views of CCS.