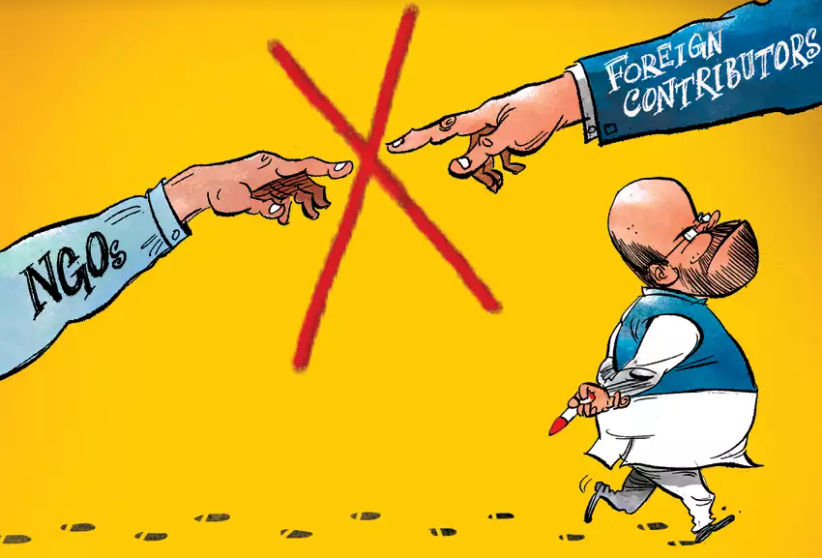

Indira Gandhi’s Emergency was a tragedy in modern India’s history. A second tragedy was not to have undone the terrible laws enacted during the Emergency. One of these is the Foreign Contributions (Regulations) Act or FCRA, which was amended last month and has become more draconian.

Its purpose is to regulate funds received by charity groups from abroad. Its consequence, however, has been to create panic among lakhs of people in India and give a bad name to our country abroad. The latest amendment evokes images among international donors of the return of India’s dreaded licence raj. At one stroke, it has undone the good work of this government in the ‘ease of doing business’ as well as the positive atmosphere created by the recent agriculture and labour reforms.

Some international donors have begun to question if grants meant for India should now be diverted to more hospitable countries where philanthropy is more welcome. There are a number of provisions in the latest amendment but let me focus on two that are almost impossible to implement.

One forbids the transfer of a foreign donation to another organisation. I shall illustrate with a real life example. An international foundation discovers a major breakthrough to improve children’s learning in reading and arithmetic. It gives a grant to a reputable Indian NGO with expertise in education to implement the programme. The latter selects ten outstanding local NGOs in the states, each with a proven record of working with schools to execute such a project. This FCRA amendment has now declared this collaborative programme illegal. There’s panic across India as thousands of local NGOs with lakhs of employees now face the prospect of closing down.

Many scientific research projects that depend on external funding face the same future. India’s green revolution wouldn’t have occurred under this FCRA amendment because the Rockefeller Foundation, which discovered the high yielding hybrid wheat in Mexico, wouldn’t have been able to sub-grant to implement the programme in the field.

The timing of this amendment is also ironic. When India is battling a deadly virus and the prime minister has applauded NGOs for their stellar role in delivering urgent relief, the regulator has decided to punish them. The NGOs were able to set up shelters and feeding centres for migrant workers with unimaginable speed precisely because modern philanthropy works in a collaborative way by sub-contracting field execution to smaller NGOs.

A second provision has put a cap of 20% on overhead expenses. Again, it misunderstands how civil society works. Those NGOs who run research institutions, schools, hospitals, and shelters out of foreign funds will now have to prove that most of their employee expenses are non-administrative. More difficult will be the job of NGOs involved in capacity building of state governments. The salaries of these employees will be termed as ‘overheads’ because their employees don’t interface with ‘beneficiaries’ but train government employees instead, who in turn deliver benefits to beneficiaries.

After this fiasco, the government should question if such a law from the Emergency era is needed. In practice, all foreign remittances – to persons, to industry, to civil society – are controlled by the finance ministry under Foreign Exchange Management Act. Why should charitable contributions be controlled by the home ministry under FCRA? If the purpose is to control terrorism, there is already the FATF (Financial Actions Task Force) to do that.

Most countries control terrorist funding through FATF type mechanisms. Moreover, NGOs are already regulated by many existing controls – Prevention of Money Laundering Act regulated by RBI, income tax and 12A certification, 80G certificate, Charities Commissioner, Registrar of Companies. In fact, the government did once consider scrapping FCRA in the early 1990s in the spirit of liberalising the economy.

If the law can’t be scrapped, why should the home ministry be burdened with regulating philanthropy? The home ministry is a well-meaning policeman, trained to distrust people, and its natural reaction is to use force. Wouldn’t it be better to entrust the regulation of civil society and philanthropy to an independent regulator in a department such as economic affairs in the finance ministry? It would then want to implement finance minister Nirmala Sitharaman’s excellent promise in 2019 to create an electronic fund-raising platform, a transparent social stock exchange under SEBI for listing social enterprises and volunteer organisations. This change would make it easier for both: For those trying to do good in India and for the home ministry, freeing it to do its job of catching terrorists.

There’s no point in blaming BJP alone. UPA made the FCRA law harsher in 2010 by extending its net to cover more civil society groups. In 2012, three NGOs lost their licence during the protest against the Kudankulam nuclear power plant. BJP went further to make compliance more onerous by increasing e-filing requirements and making licence renewal more difficult. Both political parties were complicit also in breaking the FCRA law. In 2014, the Delhi high court found them guilty of illegally receiving foreign contributions. The law was quietly amended to make it easier for political parties to accept foreign funds.

Vidura, royal counsellor in the Mahabharata, explains to King Dhritarashtra that raj dharma begins and ends with doing good to the people. A king enacts a law to catch a thief but if that law ends in harassing lakhs of innocent people, it is adharma. When this government implemented ‘self-attestation’, it was an act of dharma. But this FCRA amendment is an act of adharma. Without meaning to, the government has created fear among lakhs of idealistic, committed young people and is about to throw the baby out with the bathwater. Now’s the time to practise ‘maximum governance and minimum government’ and undo this damage.

This article was originally published in the Times of India on 3rd November 2020.

Read more: Big Tech Needs Regulation but Govt Action No Solution

Post Disclaimer

The opinions expressed in this essay are those of the authors. They do not purport to reflect the opinions or views of CCS.