Indian policymakers have faced a tricky situation over the past few months in maintaining support to the economy while being careful not to fan inflation further. The result has been a gradual exit from the stimulus put in place after the pandemic hit in early 2020. The one area of comfort through all this was India’s balance of payments. International capital flows were more than what we needed to cover the current account gap. The Reserve Bank of India (RBI) could absorb these excess dollars into its burgeoning foreign exchange kitty, especially as domestic investment by the private sector was weak.

The situation has become more complicated after Russian tanks rolled into Ukraine. International prices of crude oil have gone up sharply. Brent crude surged towards $140 a barrel on Monday, and have eased only a bit since. It is important to remember that RBI’s inflation forecast as well as the budgetary calculations of the Union government have been made assuming crude prices at $75 a barrel. The prices of other industrial commodities have also gone up in tandem with energy prices. All this is bound to hit a commodity importer such as India. Credit Suisse India equity strategist Neelkanth Mishra estimates that energy imports, both oil and non-oil, could increase by $100 billion if current prices sustain for a long time. The higher energy import bill—partly balanced by our exports of petroleum products—will put pressure on the balance of payments, especially in case portfolio investments into Indian equities ebb as a result of risk aversion. The higher oil bill will also influence headline inflation as well as the government budget, depending on the extent to which the government passes on higher oil prices to consumers and how much it absorbs through reductions in excise duty on petrol or higher fertilizer subsidies. India is nowhere near unmanageable stress in its balance of payments, as a comparison with 2013 will show. Yet, there are policy choices to be made in response to this fast-developing situation.

One useful way to frame the challenge is by looking at two types of macroeconomic balance: internal and external. They have been defined in various ways. An economy can be said to have internal balance when there is full employment or economic growth is at potential or when inflation is not accelerating. An economy with external balance has neither a large current account deficit nor surplus. The idea of an internal and external balance, and the interaction between them, is most closely identified with the work of international economists such as James Meade and Harry Johnson. J.P. Morgan chief India economist Sajjid Chinoy has earlier used this framework in an article for Mint in July 2018 (bit.ly/3vK7e1x) as well as in a couple of recent research reports.

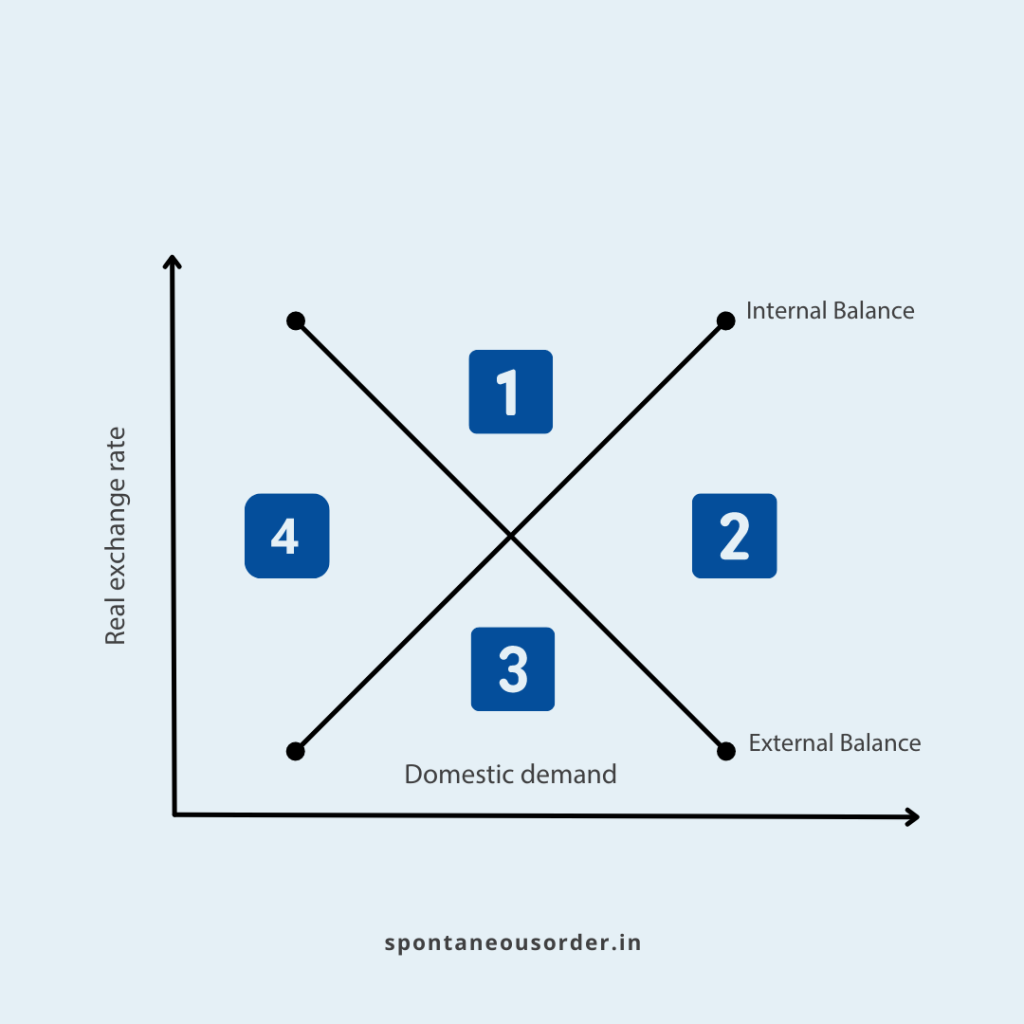

The Australian economist Trevor Swan gave a very good framework to understand how a country should respond to various combinations of internal and external imbalances in its economy. Take a look at the accompanying chart. The two policy levers in play are changes in the real exchange rate (on the Y-axis), and changes in monetary and fiscal policies to manage domestic demand (on the X-axis). The former affects the composition of demand between imported goods and domestically produced goods in an economy, or expenditure switching. The latter affects the size of domestic demand, or expenditure control.

There are now four stylised macroeconomic possibilities:

1) A current account deficit with growth below potential.

2) A current account deficit with rising inflation.

3) A current account surplus with rising inflation.

4) A current account surplus with growth below potential.

Any country that seeks to maintain an internal and external balance at the same time will have to come closer to the blissful point where the two lines intersect, by maintaining the levels of real exchange rate and domestic demand required to do the job. The Swan framework provides clues that are relevant even today, depending on where a country is in the macroeconomic space shown here. However, factors such as productivity growth, trade shocks or capital controls can change the equilibrium point.

The general rule is that the real exchange rate needs to depreciate to reduce the current account deficit or appreciate to bring down a current account surplus. Meanwhile, interest rates and net government spending have to be calibrated to manage domestic demand, depending on the combination of economic growth plus inflation that a government seeks to target. The Swan diagram can help think through the policy task conceptually, rather than give exact estimates of the necessary adjustments.

India will thus have to adapt its mix of fiscal, monetary and exchange rate policies to maintain a balance in case global turbulence persists for an extended period of time, to ensure that neither internal nor external imbalances get out of hand. A lot also depends on whether the government sees the uneven recovery or inflation as the bigger risk; how the burden of domestic adjustment is shared between fiscal and monetary policy; and whether RBI chooses to let the rupee depreciate or use its foreign exchange reserves to defend the currency. These are as much political-economy calls as they are technical ones.

This article was originally published in Mint on March 9, 2022.

Post Disclaimer

The opinions expressed in this essay are those of the authors. They do not purport to reflect the opinions or views of CCS.