Agriculture and allied sectors are the primary source of livelihood for nearly 55 per cent of India’s population (Census 2011), but accounted only for approximately 17.8 per cent of the country’s Gross Value Added in 2019-20. The yields on cereal crops are about 50 per cent lower in India, than in countries such as the United States or China, and speak to the numerous structural barriers that continue to persist in the sector. With agricultural output being utilized as important input for various industries, including retail and e-commerce, the importance of agriculture and improving yields becomes all the more pressing.

The average size of farm holdings in the country are just over 1 hectare, with small and marginal farmers holding nearly 86 per cent of the total. Small holders find it particularly difficult to invest in expensive technologies and other inputs that would improve efficiency. Additionally, the existence of a large number of intermediaries across the value chain, challenges in access to credit and technology, limited sales channels, and lack of digital infrastructure have inhibited agricultural potential. These distinctive attributes of the agriculture sector in India have made it imperative to look towards policies that improve yield, simplify value chain networks, democratize digital infrastructure, and improve access to credit and insurance.

An important solution lies in the rapid adoption of agritech, defined here as technologies and tools that improve yield, efficiency and profitability by leveraging Internet of Things, big data, artificial intelligence, machine learning, drones, and sensors in agricultural processes to track, monitor, automate and analyze.

The rationale behind the use of such emerging technologies is to minimize the impact of the ‘unknowns’ of agriculture. For instance, weather, soil and climatic conditions have historically been an important determinant of the agricultural processes in India. Using predictive technologies to detect erratic weather, sensors to map the specific type of climate and soil in an area, and machine learning algorithms that determine the appropriate crops based on this data, can substantially improve the quality and quantity of yield. In the dairy and livestock vertical, the use of sensors to monitor the health and nutrition of cattle and drones to track herds can improve efficiency and traceability.

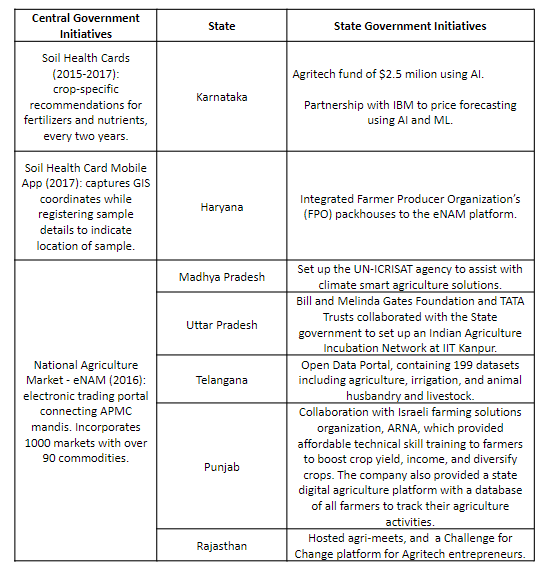

The agritech space in the country involves various actors, including think tanks, research laboratories, government, incubators, and startups. The Central as well as various State governments have undertaken numerous initiatives to enable and support the integration of smart technologies in agriculture. A few of these initiatives have been outlined below.

Recognizing the growing necessity in the country for the integration of such solutions, agritech startups have been driving innovation towards bridging the various gaps that persist along the value chain. Acting as the link between farmers, wholesalers, retailers, and consumers, these startups have been improving market linkages, while disrupting traditional agricultural systems with innovative and affordable solutions. There are over 500 agritech startups in the country, which witnessed a significant rise with the government’s Digital India campaign that has prioritized the creation of digital infrastructure for all. Some notable agritech startups which are utilizing cutting-edge technologies to drive solutions in the sector include Fasal, DeHaat, Clover, CropIn, and Intello Labs.

Even as the various stakeholders are driving smart agriculture in India, certain fundamental issues must still be addressed to effectively bring about this digital revolution. These include the issuing of blanket solutions as opposed to localized recommendations which are sensitive to geographical, socio-cultural and demographic requirements, the fragmented and unorganized structure of agriculture that involves multiple levels of intermediaries, the hesitation of small holders to undertake technologies that would not be commercially viable and cost-efficient. Additionally, even with the launch of initiatives such as Digital India, the adoption and penetration of technology is a slow process that diminishes investor interest. The lack of synergy between the various advisories and their disconnect from on-ground situations also perpetuate low uptake of smart technologies.

Therefore, the process of unleashing the true potential of agritech in the country would involve developing a synergistic relationship between the various stakeholders in the process, including the farmers themselves, enhancing investment and R&D to constantly improve and update solutions, and further improving the regulatory environment to ease accessibility of startups and other companies to create a robust ecosystem.

Read more: Predictive Policing: Drenched in Biases, Draped in Numbers

Post Disclaimer

The opinions expressed in this essay are those of the authors. They do not purport to reflect the opinions or views of CCS.