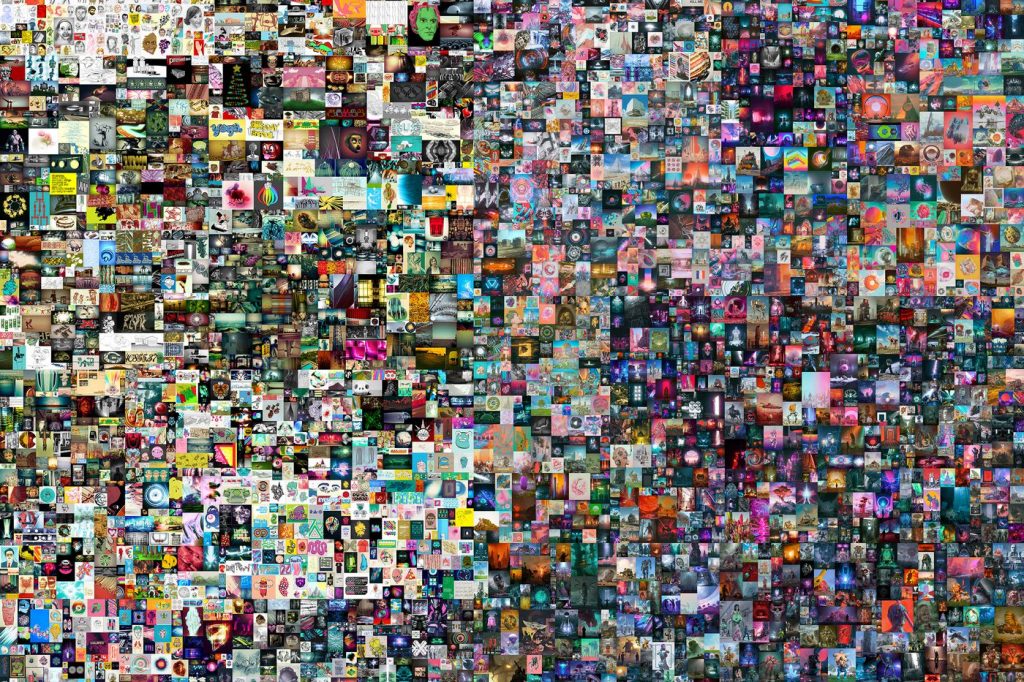

With a recent surge in the popularity of crypto art, the NFTs have become a popular form of trading digital assets. Be it Beeple’s record-breaking sale of ‘Everydays-The first 5000 days’ for $69M or the sale of Jack Dorsey’s first-ever tweet for $2.9M, people are wondering as to why such a large amount of money is being spent on something that is digital and can be viewed online for free.

So, what’s the buzz about?

An NFT or a Non-Fungible Token is a digital file with verified identity and ownership. A fungible asset means an asset that can be interchanged with other individual assets of the same kind. Fungible assets simplify the exchange and trade process, and the best example of a fungible asset is (you guessed it) money! On the other hand, a non-fungible asset is something unique that cannot be exchanged or traded. NFTs exist in all kinds of digitals forms such as art, music, video, etc. It is different from traditional artwork as it stores different information about the artwork that is distinct and provides safeguards against fake collectables.

The concept of NFT is to create a digital certificate of ownership that stores information about an item that is ‘unique’ and can be bought and sold by ‘tokenizing’ artwork. A record of who owns the artwork is stored on a digital ledger decentralized using blockchain technology, which essentially means that no one entity controls the ledger. These records are impossible to forge or duplicate and cannot be destroyed.

NFTs were introduced a long time back but first became popular due to a game called ‘CryptoKitties’ in 2017. Since then, NFTs have caught quite a few eyes but the crypto art world suddenly boomed, increasing the trade approximately 8 times from 2018 ($44M) to 2020($338M). The total value of crypto art traded in the past year is around $44M.

But why have NFTs become so popular recently? With the sale of Beeple’s ‘Everydays-The first 5000 days’ and the sale of Jack Dorsey’s first-ever tweet, the stage has been set for even greater sales in the future. This sudden surge in popularity of NFTs can be attributed to rallying prices of cryptocurrencies and people spending much of their time indoors due to the pandemic. Also, the innate desire to own something unique is a secondary factor. The ‘NBA Top Shot’ has also traded player highlights and other digital artwork for a net worth of $370M since October 2020 in the form of NFTs.

The world has already witnessed the exclusivity, along with the extent of shenanigans at posh Sotheby’s or Christie’s auction halls. Are NFTs remodelling or destroying the 21st century collectible business?

Well firstly, artists tend to benefit from NFTs a lot. They can sell their artwork directly to a global audience in digital form and at the same time eliminate the need for any third-party verification, saving themselves time and money. Since the artists can sell their work to anyone, there need not be any beau monde auctioneering around you like Sotheby’s – should you ever want to delve into the pool of NFTs. Another perk that NFTs offer is the royalty given to the artist each time their artwork is sold. Artists can also use NFTs as a means against identity theft and also for copyright laws.

Since, NFTs are an uncharted territory for the tax authorities, it seems that they are not going to incur any sales tax for at least some time. This is because sales tax is intended to apply to ‘tangible personal property’ while NFT is a non-tangible property. But according to a recent IRS guidance , if a collector uses cryptocurrency to buy an NFT (which is usually the case) and dispose of it for a higher price at a later date, it is liable for a capital gains tax. This is since cryptocurrencies are treated as a capital asset and are thus subject to capital gains tax.

Another use of NFTs is tokenizing real estate and land digitization. Some of the famous monuments around the world including but not limited to the Eiffel Tower, Statue of Liberty, Big Ben have already been tokenized on a site called Etherland.

It is expected that in the near future, we would be able to tokenize our own house on the NFT platform which could bring a huge change as it can bring liquidity to the notoriously illiquid real estate market. The real estate market as we know it is quite inefficient involving a lot of middlemen. But ‘tokenizing’ the real estate would help eliminate the middlemen and would make it possible for investors around the world to own as much, or as little, as they can afford. Also, recently a digital house dubbed ‘Mars House’ was sold for about half a million dollars. It is the first digital property to exist as an NFT (or maybe not exist!).

The trend of NFTs has started gaining momentum in India too. Last month, WazirX (an Indian cryptocurrency exchange) launched India’s first NFT platform. The exchange will not charge fee from its customers for listing and creating NFTs, but a gas fee still has to be paid. Now, many modern and traditional artisans in India can verify their work and avoid any duplicability by using NFTs. That being said, the take of Indian government on the NFT market is still unclear. While the government has not expressed any desire to ban NFTs, the upcoming private cryptocurrency Bill surely casts a doubt on the legality of NFTs in India. As of now, NFTs are traded as digital art pieces but investors advise to be cautious as these tokens are high-risk assets.

Every new trend has some disadvantages, and this trend is no exception. Inexperience in crypto and blockchain technology may serve as the barriers to entry for immature artists. Moreover, for the creation of an ‘NFT’ token, a small fee, also known as ‘gas’, has to be paid by both parties involved. This fee is used by miners to process transactions and the amount of ‘gas’ to be paid depends on the size of transaction and how fast it is to be executed. It is an essential regulator that prevents anyone from spamming the Ethereum network. Another disadvantage is the massive carbon footprint caused by the mining of cryptocurrency used for purchasing these tokens as it takes place on the blockchain network that requires huge amounts of raw power powered by fossil fuels. For example, the whole Ethereum blockchain consumes energy equal to that of a small country like Libya.

NFTs are certainly the topic of the month and maybe even have the potential to be the future of art itself. But right now, there are some pertinent questions which need to be answered. What are the legal rights of buyers and what does it mean to own a tweet? What if the tweet is deleted in the future or if Twitter shuts down permanently? Artists may also con people by tokenizing multiple NFTs of the same item on the same or different blockchains.

As things stand, the ownership of an NFT confers no actual rights, other than being able to say you own the work. You don’t own the copyright and you don’t get a physical print, and anyone can look at the image on the web. What you are essentially paying for is a record in a public database that says you own it. And while that is certainly worth something, whether it is worth millions of dollars remains to be seen.

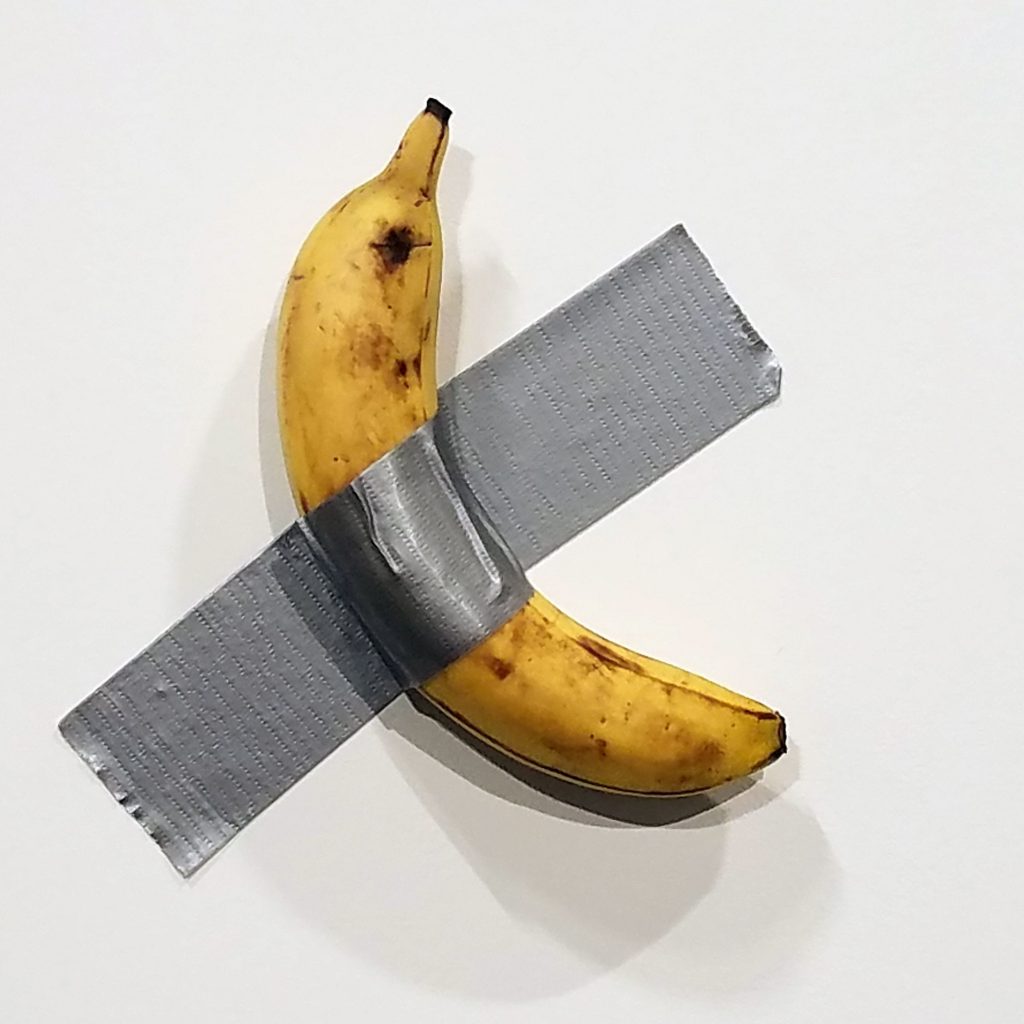

Proponents argue that NFTs are not so different from physical works of art i.e., that the different attributes of an artwork are worth what we choose they are worth. This does not mean that the historical significance and immaculate brushwork and technical skill of a Van Gogh are worthless attributes, it just means that the value of those attributes is what we choose to put on them. When people buy a banana taped to a wall for eye-watering amounts of money, they aren’t really interested in buying the banana, but rather in ‘owning’ the bragging right to say that they bought it and the story surrounding it. NFTs simply take this concept to the extreme and remove any pretence of buying artwork for its physical attributes.

In the past few days, the prices of some NFTs have tumbled 70% which is making investors jittery around the world. While this level of volatility isn’t indicative of a bubble on its own, it becomes one when it happens in the backdrop of easing monetary policy around the globe with interest rates going to zero and central banks pulling out all stops to prop up the world economy. This is one reason why people shouldn’t jump on the NFT bandwagon too soon. The transformation of blockchain technology into a more eco-friendly one will play a pivotal role in the fate of NFTs. That being said, whether or not this craze stays, NFTs are proof that the public is in favour of a crypto-economy and is ready to take risks for a decentralized system of finance.

Read more: Signs of hope for 100 million missing women.

Post Disclaimer

The opinions expressed in this essay are those of the authors. They do not purport to reflect the opinions or views of CCS.